Home > Miscellaneous >

Individual Tax Template >

State Tax Withholding Forms > New York State Tax Withholding Forms >

NY IT-2104 Employee's Withholding Allowance Template

NY IT-2104 Employee's Withholding Allowance Form

At Speedy Template, You can download NY IT-2104 Employee's Withholding Allowance Form . There are a few ways to find the forms or templates you need. You can choose forms in your state, use search feature to find the related forms. At the end of each page, there is "Download" button for the forms you are looking form if the forms don't display properly on the page, the Word or Excel or PDF files should give you a better reivew of the page.

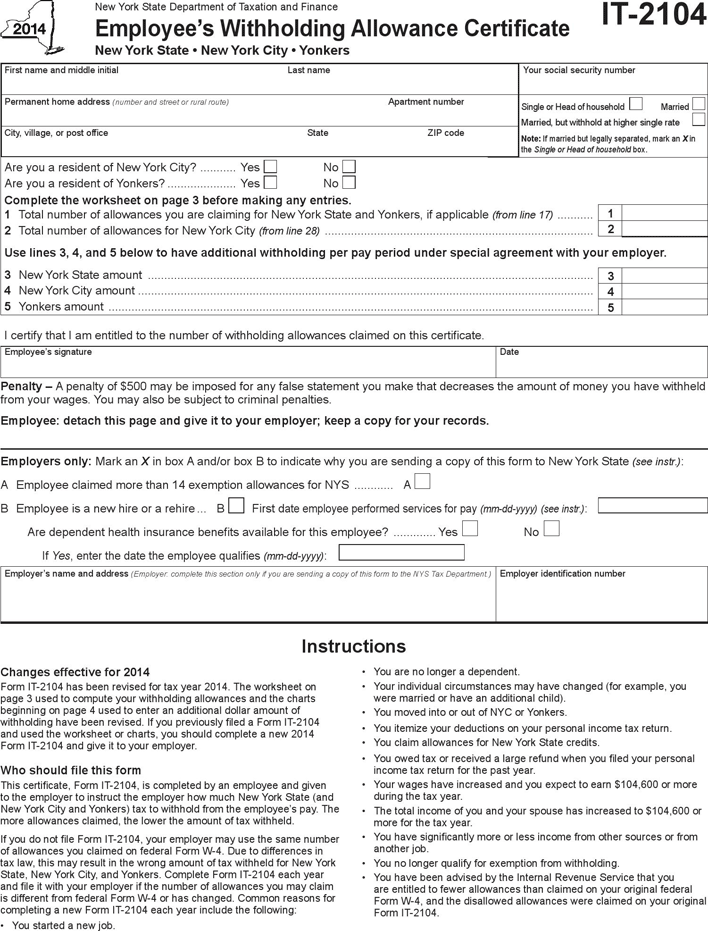

First name and middle initial Last name Your social security number

Permanent home address

(number and street or rural route) Apartment number

City,village,orpostofce State ZIPcode

Are you a resident of New York City ........... Yes No

Are you a resident of Yonkers ..................... Yes No

Complete the worksheet on page 3 before making any entries.

1 TotalnumberofallowancesyouareclaimingforNewYorkStateandYonkers,ifapplicable

(from line 17) ...........

1

2 Total number of allowances for New York City

(from line 28) ..................................................................................

2

Use lines 3, 4, and 5 below to have additional withholding per pay period under special agreement with your employer.

3 NewYorkStateamount ........................................................................................................................................

3

4 New York City amount ...........................................................................................................................................

4

5 Yonkers amount ....................................................................................................................................................

5

NewYorkStateDepartmentofTaxationandFinance

Employee’sWithholdingAllowanceCerticate

NewYorkState•NewYorkCity•Yonkers

SingleorHeadofhousehold

Married

Married, but withhold at higher single rate

Note:Ifmarriedbutlegallyseparated,markanX in

the Single or Head of household box.

IcertifythatIamentitledtothenumberofwithholdingallowancesclaimedonthiscerticate.

Employee’ssignature Date

Employer’s name and address

(Employer: complete this section only if you are sending a copy of this form to the NYS Tax Department.)

Employeridenticationnumber

Penalty – A penalty of $500 may be imposed for any false statement you make that decreases the amount of money you have withheld

from your wages. You may also be subject to criminal penalties.

Employee: detach this page and give it to your employer; keep a copy for your records.

Changes effective for 2014

FormIT-2104hasbeenrevisedfortaxyear2014.Theworksheeton

page 3 used to compute your withholding allowances and the charts

beginningonpage4usedtoenteranadditionaldollaramountof

withholdinghavebeenrevised.IfyoupreviouslyledaFormIT-2104

andusedtheworksheetorcharts,youshouldcompleteanew2014

FormIT-2104andgiveittoyouremployer.

Whoshouldlethisform

Thiscerticate,FormIT-2104,iscompletedbyanemployeeandgiven

totheemployertoinstructtheemployerhowmuchNewYorkState(and

NewYorkCityandYonkers)taxtowithholdfromtheemployee’spay.The

moreallowancesclaimed,thelowertheamountoftaxwithheld.

IfyoudonotleFormIT-2104,youremployermayusethesamenumber

ofallowancesyouclaimedonfederalFormW-4.Duetodifferencesin

taxlaw,thismayresultinthewrongamountoftaxwithheldforNewYork

State,NewYorkCity,andYonkers.CompleteFormIT-2104eachyear

andleitwithyouremployerifthenumberofallowancesyoumayclaim

isdifferentfromfederalFormW-4orhaschanged.Commonreasonsfor

completinganewFormIT-2104eachyearincludethefollowing:

• Youstartedanewjob.

• Youarenolongeradependent.

• Yourindividualcircumstancesmayhavechanged(forexample,you

were married or have an additional child).

• YoumovedintooroutofNYCorYonkers.

• Youitemizeyourdeductionsonyourpersonalincometaxreturn.

• YouclaimallowancesforNewYorkStatecredits.

• Youowedtaxorreceivedalargerefundwhenyouledyourpersonal

incometaxreturnforthepastyear.

• Yourwageshaveincreasedandyouexpecttoearn$104,600ormore

duringthetaxyear.

• Thetotalincomeofyouandyourspousehasincreasedto$104,600or

moreforthetaxyear.

• Youhavesignicantlymoreorlessincomefromothersourcesorfrom

another job.

• Younolongerqualifyforexemptionfromwithholding.

• YouhavebeenadvisedbytheInternalRevenueServicethatyou

are entitled to fewer allowances than claimed on your original federal

FormW-4,andthedisallowedallowanceswereclaimedonyouroriginal

FormIT-2104.

Instructions

Employers only: Mark an XinboxAand/orboxBtoindicatewhyyouaresendingacopyofthisformtoNewYorkState (see instr.):

A Employeeclaimedmorethan14exemptionallowancesforNYS ............ A

B Employeeisanewhireorarehire ... B Firstd

ate employee performed services for pay (mm-dd-yyyy)

(see instr.):

Aredependenthealthinsurancebenetsavailableforthisemployee ............. Yes No

IfYes,enterthedatetheemployeequalies(mm-dd-yyyy):

IT-2104