Home > Legal >

Legal >

Power of Attorney Template > Montana Power of Attorney Form >

Montana Tax Power of Attorney Template

Montana Tax Power of Attorney Form

At Speedy Template, You can download Montana Tax Power of Attorney Form . There are a few ways to find the forms or templates you need. You can choose forms in your state, use search feature to find the related forms. At the end of each page, there is "Download" button for the forms you are looking form if the forms don't display properly on the page, the Word or Excel or PDF files should give you a better reivew of the page.

The Montana tax power of attorney is a legal document used by the grantor to authorize the attorney-in-fact to act on his/her behalf in his/her tax related matters.

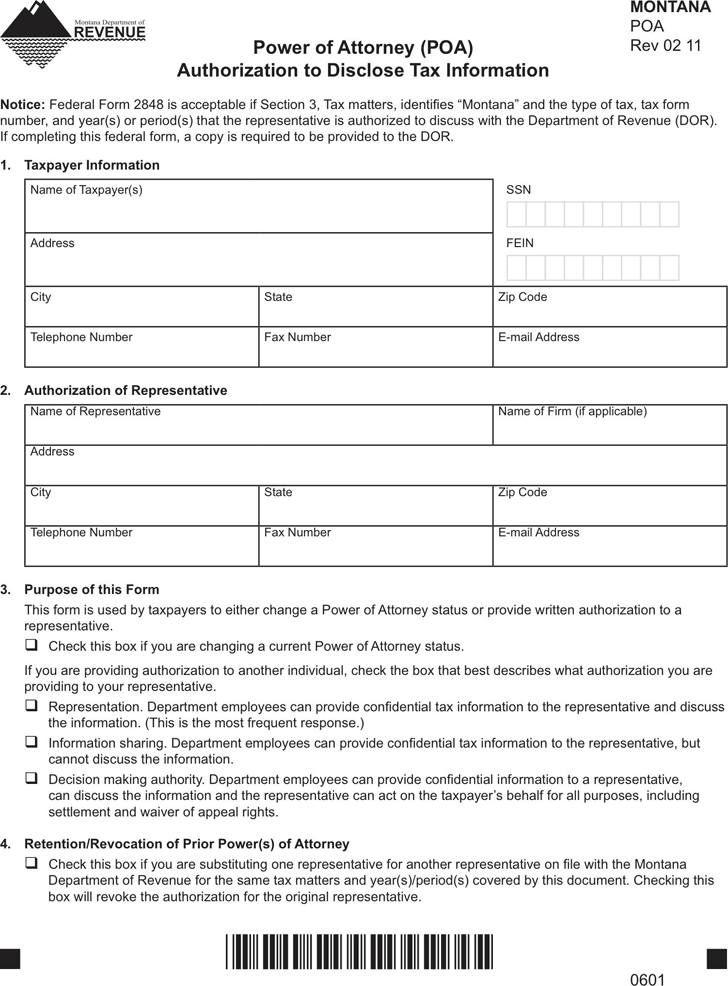

MONTANA

POA

Rev 02 11

Power of Attorney (POA)

Authorization to Disclose Tax Information

Notice: Federal Form 2848 is acceptable if Section 3, Tax matters, identifi es “Montana” and the type of tax, tax form

number, and year(s) or period(s) that the representative is authorized to discuss with the Department of Revenue (DOR).

If completing this federal form, a copy is required to be provided to the DOR.

1. Taxpayer Information

Name of Taxpayer(s) SSN

Address FEIN

City State Zip Code

Telephone Number Fax Number E-mail Address

2. Authorization of Representative

Name of Representative Name of Firm (if applicable)

Address

City State Zip Code

Telephone Number Fax Number E-mail Address

3. Purpose of this Form

This form is used by taxpayers to either change a Power of Attorney status or provide written authorization to a

representative.

Check this box if you are changing a current Power of Attorney status.

If you are providing authorization to another individual, check the box that best describes what authorization you are

providing to your representative.

Representation. Department employees can provide confi dential tax information to the representative and discuss

the information. (This is the most frequent response.)

Information sharing. Department employees can provide confi dential tax information to the representative, but

cannot discuss the information.

Decision making authority. Department employees can provide confi dential information to a representative,

can discuss the information and the representative can act on the taxpayer’s behalf for all purposes, including

settlement and waiver of appeal rights.

4. Retention/Revocation of Prior Power(s) of Attorney

Check this box if you are substituting one representative for another representative on fi le with the Montana

Department of Revenue for the same tax matters and year(s)/period(s) covered by this document. Checking this

box will revoke the authorization for the original representative.

0601

*06010101*

Print Form

Clear Form