Home > Legal >

Legal >

Power of Attorney Template > Illinois Power of Attorney Form >

Illinois Tax Power of Attorney Template

Illinois Tax Power of Attorney Form

At Speedy Template, You can download Illinois Tax Power of Attorney Form . There are a few ways to find the forms or templates you need. You can choose forms in your state, use search feature to find the related forms. At the end of each page, there is "Download" button for the forms you are looking form if the forms don't display properly on the page, the Word or Excel or PDF files should give you a better reivew of the page.

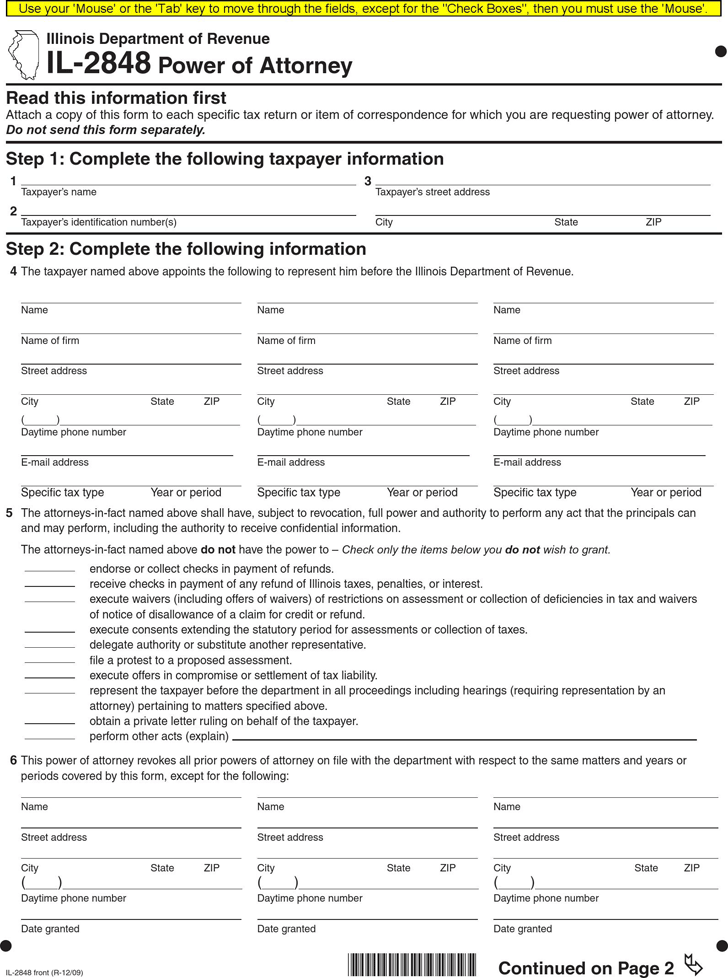

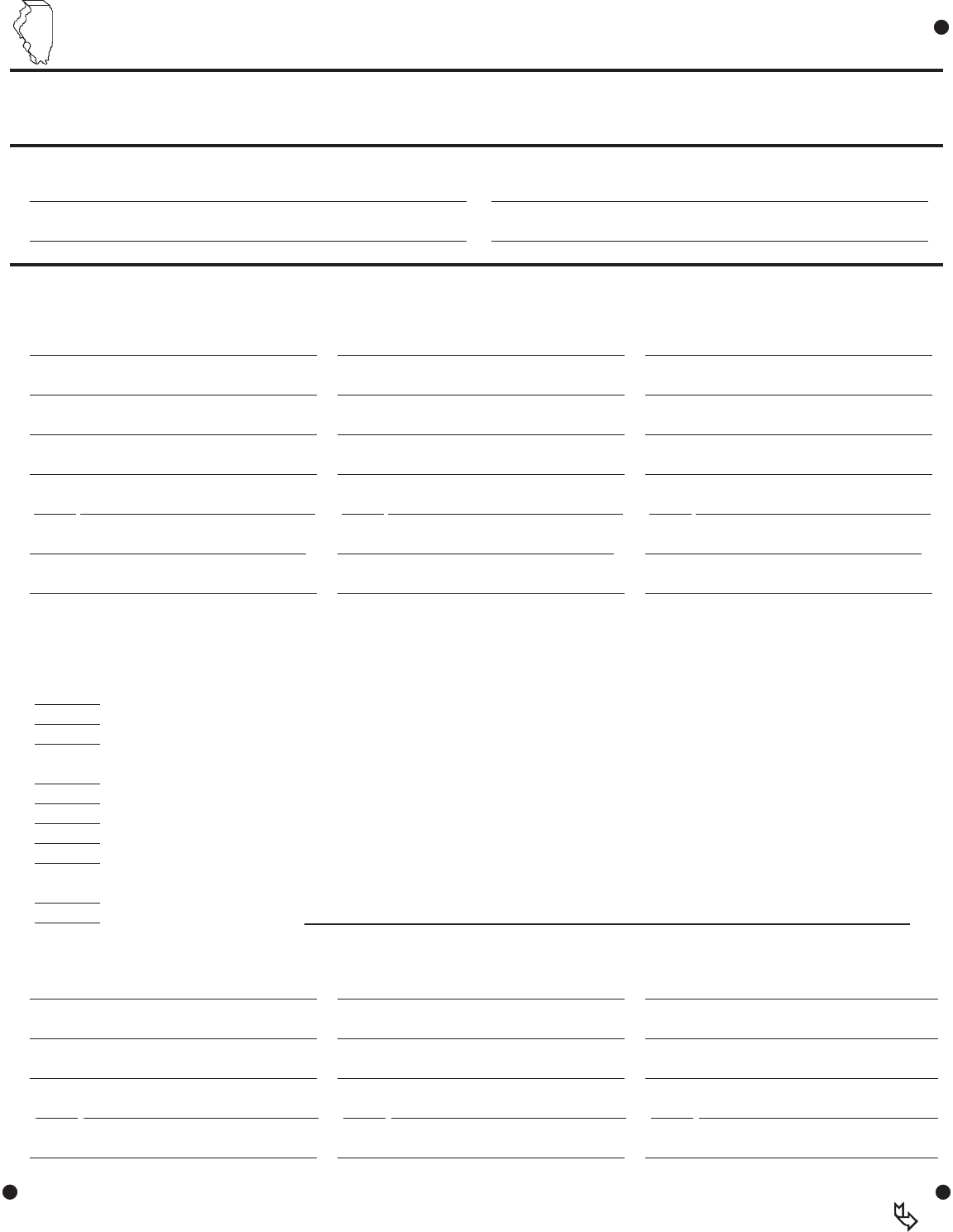

Read this information fi rst

Attach a copy of this form to each specifi c tax return or item of correspondence for which you are requesting power of attorney.

Do not send this form separately.

Step 1: Complete the following taxpayer information

1 3

Taxpayer’s name Taxpayer’s street address

2

Taxpayer’s identifi cation number(s) City State ZIP

Step 2: Complete the following information

4 The taxpayer named above appoints the following to represent him before the Illinois Department of Revenue.

Name Name Name

Name of fi rm Name of fi rm Name of fi rm

Street address Street address Street address

City State ZIP City State ZIP City State ZIP

(

) ( ) ( )

Daytime phone number Daytime phone number Daytime phone number

E-mail address E-mail address E-mail address

Specifi c tax type Year or period Specifi c tax type Year or period Specifi c tax type Year or period

5 The attorneys-in-fact named above shall have, subject to revocation, full power and authority to perform any act that the principals can

and may perform, including the authority to receive confi dential information.

The attorneys-in-fact named above do not have the power to – Check only the items below you do not wish to grant.

endorse or collect checks in payment of refunds.

receive checks in payment of any refund of Illinois taxes, penalties, or interest.

execute waivers (including offers of waivers) of restrictions on assessment or collection of defi ciencies in tax and waivers

of notice of disallowance of a claim for credit or refund.

execute consents extending the statutory period for assessments or collection of taxes.

delegate authority or substitute another representative.

fi le a protest to a proposed assessment.

execute offers in compromise or settlement of tax liability.

represent the taxpayer before the department in all proceedings including hearings (requiring representation by an

attorney) pertaining to matters specifi ed above.

obtain a private letter ruling on behalf of the taxpayer.

perform other acts (explain)

6 This power of attorney revokes all prior powers of attorney on fi le with the department with respect to the same matters and years or

periods covered by this form, except for the following:

Name Name Name

Street address Street address Street address

City State ZIP City State ZIP City State ZIP

( ) ( ) ( )

Daytime phone number Daytime phone number Daytime phone number

Date granted Date granted Date granted

Illinois Department of Revenue

IL-2848 Power of Attorney

IL-2848 front (R-12/09)

Continued on Page 2

*965201110*

Use your 'Mouse' or the 'Tab' key to move through the fields, except for the "Check Boxes", then you must use the 'Mouse'.