Home > Miscellaneous >

Individual Tax Template >

State Tax Withholding Forms > Arizona State Tax Withholding Forms >

Arizona Form A-4 (2013)

Arizona Form A-4 (2013)

At Speedy Template, You can download Arizona Form A-4 (2013) . There are a few ways to find the forms or templates you need. You can choose forms in your state, use search feature to find the related forms. At the end of each page, there is "Download" button for the forms you are looking form if the forms don't display properly on the page, the Word or Excel or PDF files should give you a better reivew of the page.

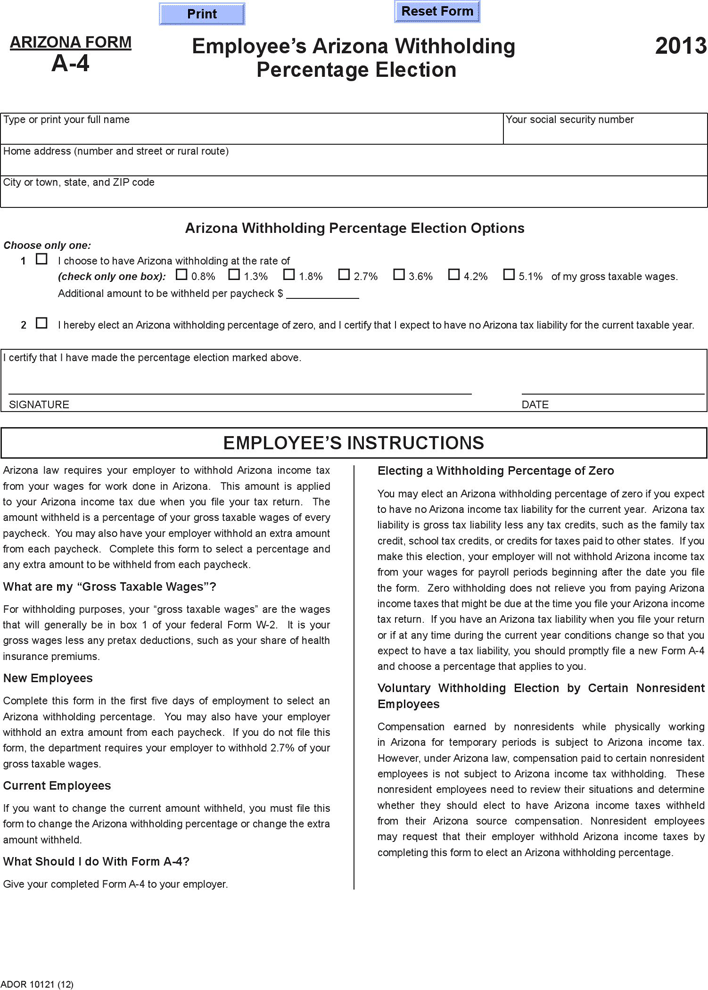

Employee’s Arizona Withholding

Percentage Election

Type or print your full name Your social security number

Home address (number and street or rural route)

City or town, state, and ZIP code

Arizona Withholding Percentage Election Options

Choose only one:

1 I choose to have Arizona withholding at the rate of

(check only one box): 0.8% 1.3% 1.8% 2.7% 3.6% 4.2% 5.1% of my gross taxable wages.

Additional amount to be withheld per paycheck $

2 I hereby elect an Arizona withholding percentage of zero, and I certify that I expect to have no Arizona tax liability for the current taxable year.

ARIZONA FORM

A-4

EMPLOYEE’S INSTRUCTIONS

Arizona law requires your employer to withhold Arizona income tax

from your wages for work done in Arizona. This amount is applied

to your Arizona income tax due when you fi le your tax return. The

amount withheld is a percentage of your gross taxable wages of every

paycheck. You may also have your employer withhold an extra amount

from each paycheck. Complete this form to select a percentage and

any extra amount to be withheld from each paycheck.

What are my “Gross Taxable Wages”

For withholding purposes, your “gross taxable wages” are the wages

that will generally be in box 1 of your federal Form W-2. It is your

gross wages less any pretax deductions, such as your share of health

insurance premiums.

New Employees

Complete this form in the fi rst fi ve days of employment to select an

Arizona withholding percentage. You may also have your employer

withhold an extra amount from each paycheck. If you do not fi le this

form, the department requires your employer to withhold 2.7% of your

gross taxable wages.

Current Employees

If you want to change the current amount withheld, you must fi le this

form to change the Arizona withholding percentage or change the extra

amount withheld.

What Should I do With Form A-4

Give your completed Form A-4 to your employer.

Electing a Withholding Percentage of Zero

You may elect an Arizona withholding percentage of zero if you expect

to have no Arizona income tax liability for the current year. Arizona tax

liability is gross tax liability less any tax credits, such as the family tax

credit, school tax credits, or credits for taxes paid to other states. If you

make this election, your employer will not withhold Arizona income tax

from your wages for payroll periods beginning after the date you fi le

the form. Zero withholding does not relieve you from paying Arizona

income taxes that might be due at the time you fi le your Arizona income

tax return. If you have an Arizona tax liability when you fi le your return

or if at any time during the current year conditions change so that you

expect to have a tax liability, you should promptly fi le a new Form A-4

and choose a percentage that applies to you.

Voluntary Withholding Election by Certain Nonresident

Employees

Compensation earned by nonresidents while physically working

in Arizona for temporary periods is subject to Arizona income tax.

However, under Arizona law, compensation paid to certain nonresident

employees is not subject to Arizona income tax withholding. These

nonresident employees need to review their situations and determine

whether they should elect to have Arizona income taxes withheld

from their Arizona source compensation. Nonresident employees

may request that their employer withhold Arizona income taxes by

completing this form to elect an Arizona withholding percentage.

I certify that I have made the percentage election marked above.

SIGNATURE DATE

ADOR 10121 (12)

2013

Print

Reset Form

Arizona Form A-4 (2013)